Security & Fraud Awareness Tips: Check Fraud

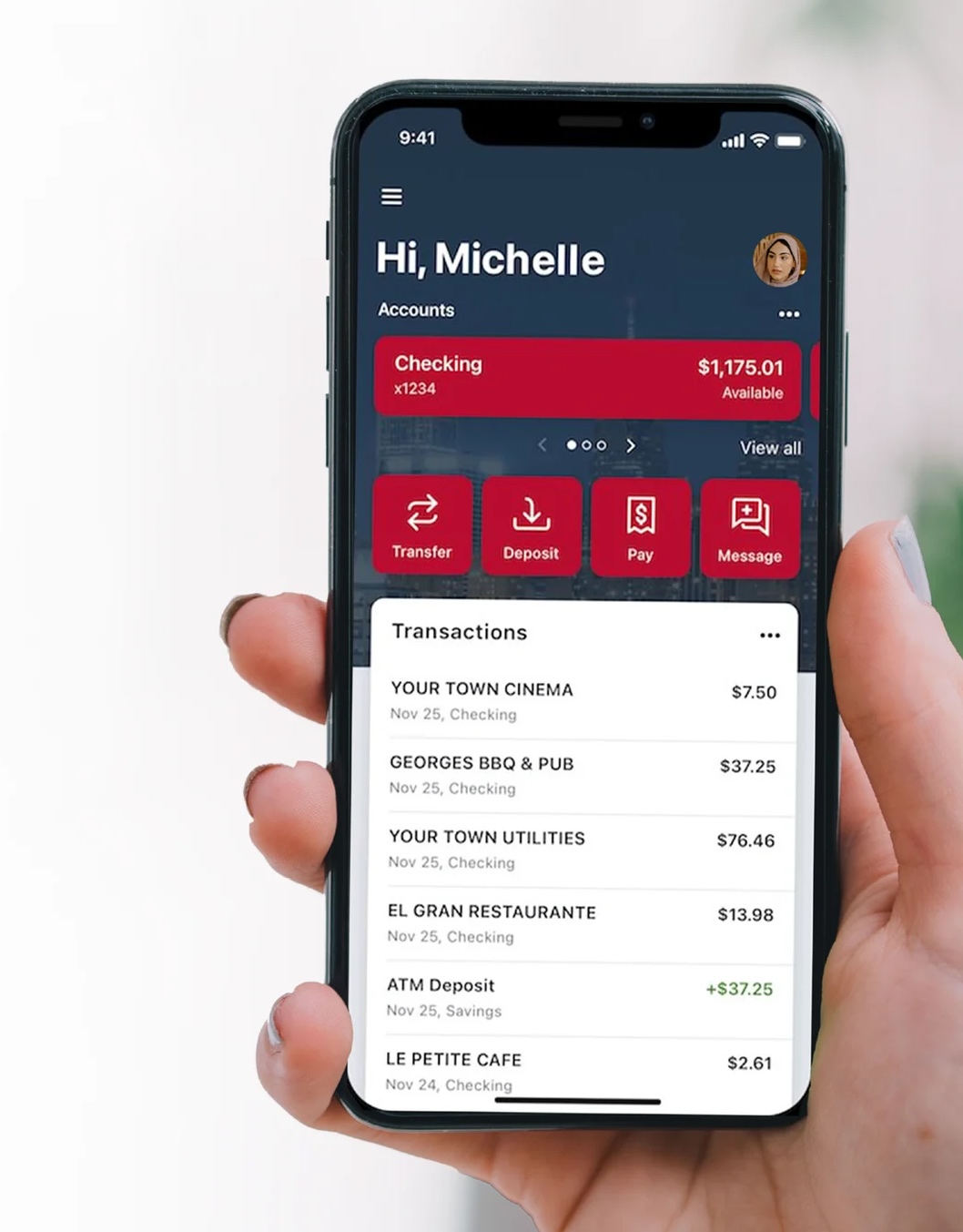

- Log into your digital banking platform daily to review account activity. By reviewing your transactions and check images daily, you will be aware and able to notify Meridian of any discrepancies as quickly as possible. Designate a back-up person on your business account to review accounts if you are absent or unable to access digital banking. When reviewing account activity, be sure to verify that the payee names in your check images have not been altered.

- Set up account alerts to notify you when there are new transactions in your account or if your balance dips below a certain threshold. Alerts for these actions will give you real-time notifications of any changes that you did or did not make. If you receive an alert that was not prompted by something you did, contact Meridian immediately with notification of potential fraud.

- Sign up for direct deposit to receive your tax refund. When filing your taxes, use ACH to receive your tax refund instead of accepting a check. You can update your refund method directly in your tax software or you can ask your accountant to update for you. Click here for more information on the IRS website.

For business banking customers, Meridian offers Positive Pay to prevent check or ACH fraud.

Upload a list of checks or ACH’s for matching to control unauthorized activity. If a payment presented doesn’t match what is on your list, you’ll decide if you want to pay or return it. If you’re interested in setting up Positive Pay for your business, fill out the form below to get started.

Not signed up for Digital Banking? Enroll today!

If you have a personal account, visit: meridianbanker.com/digital-banking

If you have a business account, please fill out the form below to get started.

Benefits Include:

- Electronic statements and notices

- Bill pay

- Account transfers

- Mobile deposit

- Card controls

- Account alerts

- Secure messaging